What is an Employer of Record Philippines?

An Employer of Record in the Philippines is a third party that manages an organization’s employees. This includes onboarding, contract management, payroll management, ongoing HR support and offboarding.

An EOR acts as the official employer of an organization’s employees and is responsible for managing payroll, benefits administration, tax withholding and compliance with labor laws.

This is the ideal HR solution for businesses that quickly want to scale without setting up a legal entity in the Philippines while staying compliant with local labor laws and regulations.

Overview of the Employment Landscape in the Philippines

The Philippines has a workforce population of 112 million with an employment rate of 95.3%, enabling businesses to access a wide talent pool for their outsourced team.

According to the Philippine Market Report: Shared Services State of the Industry 2023 by Shared Services and Outsourcing Network (SSON), the Philippines has a significantly larger population of individuals with university bachelor's degrees than Kuala Lumpur, Warsaw or even Chicago.

This gives the Philippines a competitive edge as a leading location for global shared services activities.

Benefits of hiring in the Philippines

You can experience the following benefits by hiring your staff in the Philippines.

Cost savings

The Philippines has relatively low labor costs compared to developed countries while maintaining the quality of talent in the workforce.

Access to top talent

The Philippines workforce is predominantly highly educated, equipping Filipino employees with the necessary skills and expertise to perform in different positions, especially in specialized fields.

Strong work ethic

Filipinos value hard work, diligence and commitment to family and their communities. Filipino employees are also known to be loyal and dedicated to their employees if they belong to a fulfilling work environment.

Cultural compatibility

Filipino employees are known for their warm hospitality, adaptability and resilience. These qualities allow them to thrive in different work environments and successfully work alongside an international team.

Timezone advantage

The Philippine workforce is geared towards working in a timezone-neutral environment. Many employees are open to working “day shifts” or “night shifts”, ensuring that they cover working hours, regardless of a business’s location.

Familiarity with Western culture

Its history of colonization from Western countries gives Filipino employees a deep understanding of Western culture, allowing them to adapt to different work settings.

Importance of Employer of Record Services

An EOR supports international organizations in managing remote employees based in different locations.

An Employer of Record functions as an independent legal entity for employment purposes. The staff you hire are employed under your EOR on paper, which is crucial for international employment purposes. It allows you to legally outsource employees without having to set up an entity in the country.

Partnering with an EOR enables you to focus on developing your core competencies rather than being bogged down by administrative tasks.

Exploring the Role of an EOR

An Employer of Record performs HR and legal functions such as:

- Enabling businesses to legally hire employees in other countries

- Handle benefits administration for global employees

- Manages payrolls processes for employees in their local currencies

While an EOR is the employer of your staff on paper, they are not involved in the day-to-day work life of your employees beyond HR functions.

Benefits of Partnering with an EOR in the Philippines

Most employment solutions are geared towards providing benefits for the business owner.

As a leader, you must create a work environment that inspires and motivates your staff.

An Employer of Record can help you by providing benefits to business owners and employees.

Benefits of partnering with an EOR in the Philippines for employers

- Lower costs to employ top talent

- Eliminate office rental costs

- Remove payroll issues

- Seamless compliance with labor standards

- Secure local benefits for employees

- No separate local business entity required

- Manage employees directly and retain control of business processes

- Keep team engagement high

- Prevent the loss of great talents

Benefits of partnering with an EOR in the Philippines for employees

- Healthy work-life balance

- Access to benefits of corporate employment

- Security of having an employer on record

- Annual leave entitlement

- Social contribution, benefits, and taxation filing

- Guaranteed compliance with Philippine labor standards

Key Considerations when Choosing an EOR in the Philippines

There are several factors to consider before you choose an Employer of Record in the Philippines.

Track record of success

You must ensure that a potential EOR of your choice delivers on its promises. Search for customer testimonials and check references from existing clients to ensure that they’re happy with the services provided by their Employer of Record.

Expertise and knowledge of local labor markets

An Employer of Record must have first-hand knowledge and experience in the Philippine labor market to ensure that you have a competitive advantage when it comes to acquiring top talent while staying compliant with local regulations.

Transparency about pricing

Partner with an Employer of Record that is transparent about their pricing. They should share any additional setup or fees and taxes to ensure that your budget is not impacted by hidden costs.

Level of support and responsiveness

Your chosen Employer of Record should be active and responsive in supporting you and your team. This can be determined by how effectively they respond to your queries and provide timely support to your local workforce in the proper time zone.

Accurate provision of employee burden calculations and costs

Employer burden calculations in the Philippines include costs such as social contributions and value-added tax (VAT) requirements. The Employer of Record must give you a clear breakdown of these calculations to inform you of the labor requirements in the Philippines.

Philippine Labor Laws and Regulations

We’ve shortlisted some of the most important Philippine labor laws and regulations to remember. A credible Employer of Record will incorporate these requirements into your employment processes to ensure compliance with local labor laws.

Security of Tenure

Employees have the right to job security. They may not be dismissed due to unjust and unauthorized causes. An employer must implement due process, which includes extensive investigation, before enacting an employee’s dismissal. There is typically a probationary employment period where employees must meet specific KPIs before being qualified for regular employment.

Work Days and Hours

The standard workday for Filipino employees is eight (8) hours with one (1) hour for meals and rest. Employees are entitled to additional pay for working beyond their official work hours.

Weekly Rest Day

While the law doesn’t require an employee’s rest day to be on the weekend, employees are entitled to at least 24 hours of uninterrupted rest day after every six consecutive working days.

Payment of Wages

Compensation must be paid in cash, legal tender, bank transfer or on-site. All forms of wages must be paid directly to employees and given every two weeks, but not exceeding 16 days.

Safe Working Conditions

Employers must provide safety precautions to protect employees from sickness, injury and death.

Right to self-organization and collective bargaining

All employees have the right to self-organize and join a union to participate in collective bargaining, which is the negotiation process for resolving an issue between the employer and employees.

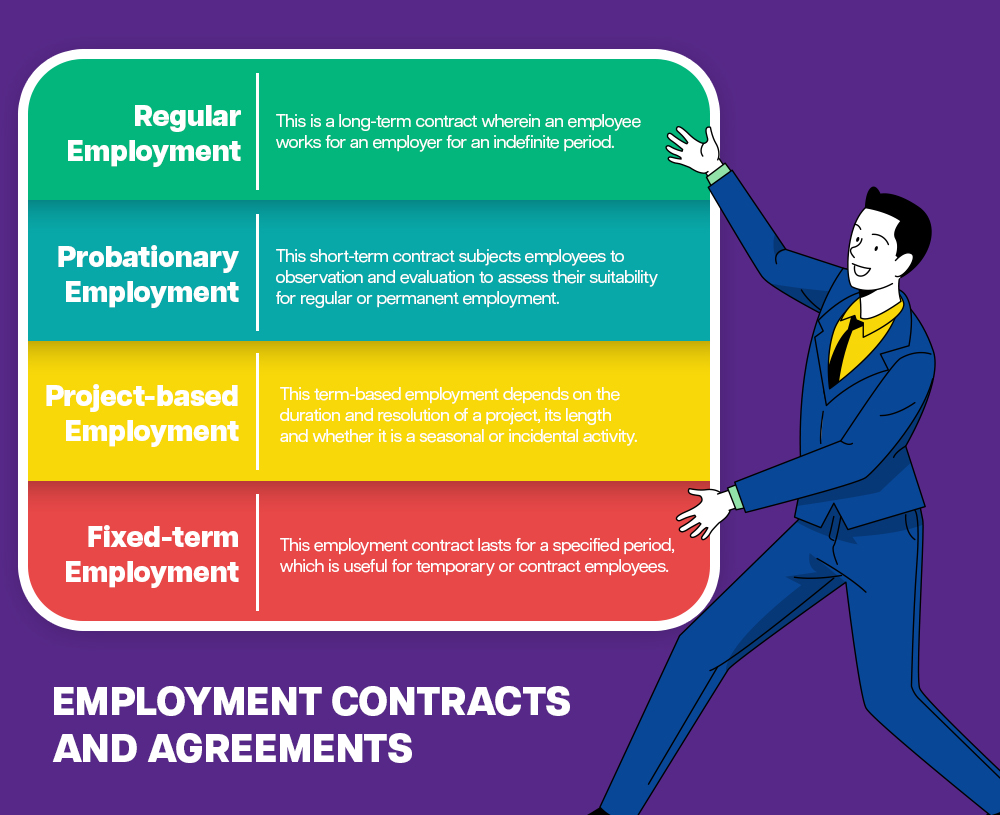

Employment Contracts and Agreements

In the Philippines, there are several categories of employment contracts based on the nature of that employment. Your Employer of Record should be able to create an employment contract and find the right staff for your business needs.

Regular employment

This is a long-term contract wherein an employee works for an employer for an indefinite period.

Probationary employment

This short-term contract subjects employees to observation and evaluation to assess their suitability for regular or permanent employment.

Project-based employment

This term-based employment depends on the duration and resolution of a project, its length and whether it is a seasonal or incidental activity.

Fixed-term employment

This employment contract lasts for a specified period, which is useful for temporary or contract employees.

Compliance with Taxation and Social Security Requirements

Employers in the Philippines must adhere to local payroll compliance regulations.

The four main statutory contributions employers deduct from employees’ salaries, which an Employer of Record can manage to ensure compliance and accurate deductions.

Income tax

Employers don’t contribute to their employees’ income tax but act as withholding agents by deducting income tax from their employees’ monthly salaries.

The Philippines use a graduated income tax comprising six tax brackets:

- ₱0 to ₱250,000: 0%

- ₱250,001 to ₱400,000: 15%

- ₱400,001 to ₱800,000: 20%

- ₱800,001 to ₱2,000,000: 25%

- ₱2,000,001 to ₱8,000,00: 30%

- Over ₱8,000,000: 35%

Social security

The Philippines’ social security system (SSS) is an insurance fund that protects employees from financial burdens related to disability, maternity, sickness, old age and other contingencies. The monthly contribution rate is 9.5% for employers and 4.5% for employees, with the amount capped above a monthly salary of PHP 29,750.

Philippine Health Insurance Corporation (PhilHealth)

Employers must contribute to the Philippine Health Insurance Corporation (PhilHealth), the state health insurance fund for employees. The total contribution rate is 4% of the employee’s gross income, with the amount capped above PHP 80,000.

Home Development Mutual Fund (HDMF)

The Home Development Mutual Fund (HDMF), also known locally as the Pag-IBIG Fund, is a government-guaranteed savings fund for employees to help them finance their new homes. Monthly contributions are mandatory for SSS-covered employees, and both employers and employees contribute PHP 100 to Pag-IBIG Fund.

Other Employee Benefits

Here are other employee benefits that employers must consider if they will legally outsource their staff in the Philippines.

- 13th-Month Pay

- Overtime Pay

- Premium Pay

- Night Shift Differential

- Separation Pay

- Retirement Pay

- Leave benefits

Probation and Termination

According to Art. 281. of the Labor Code of the Philippines, the probationary employment of an individual must not exceed six months from the date they started working.

Grounds for termination of an employee

An employer must ensure they have just and authorized cause for dismissing an employee. The following reasons can be considered grounds for termination of employment:

- Serious misconduct

- Willful disobedience

- Gross and habitual neglect of duty

- Fraud or breach of trust

- Commission of a crime or offence against the employer, his family or representative

Employer of Record vs. Other Employment Solutions

An Employer of Record is the most advantageous employment solution for businesses that want to scale efficiently, remain compliant and provide a great work experience for their employees.

We’ve shortlisted the most common types of employment solutions in the Philippines and why you should choose to partner with an Employer of Record.

Employer of Record

An Employer of Record is ideal for small to medium businesses, as an EOR typically does not require you to hire a minimum number of employees after partnering with them. While an Employer of Record will handle the heavy lifting of HR-related administrative tasks, they will ensure that you are still included in the employment processes.

Your EOR will also handle the compliance requirements of outsourcing employees without requiring you to build a local incorporation and entity to hire, employ and manage your staff legally.

Business Process Outsourcing

Similarly to EORs, business process outsourcing (BPO) providers allow you to legally hire remote staff without having to set up an entity.

But instead of outsourcing individual employees, a BPO provider takes care of your team selection, salary offer, training and hiring and firing of your team.

Typically used by big brands who do not require operational control of their offshore team’s day-to-day operations, this means that while BPO services can provide mass employment, they can’t guarantee quality service and output. Because BPO providers often outsource entire departments or teams, you cannot handpick individual employees or provide proper training for them.

Setting up a Legal Entity

Setting up a legal entity in a foreign country allows a business to take on all employer responsibilities, including HR, payroll, and legal compliance. This gives business owners complete control over their employment processes while staying compliant with local labor laws and regulations.

However, establishing a legal entity can take several months, which can slow down a business’s market entry. It also requires a significant initial investment and ongoing costs to maintain the entity. This is not ideal for businesses that want to scale quickly and cost-effectively.

Employer of Record Benefits

There are three key benefits to partnering with an Employer of Record.

Mitigating Legal and Compliance Risks

As the designated employer for your team, your Employer of Record is responsible for the legalities of your employment processes. They will ensure that your business is compliant with local laws and regulations while mitigating legal risks.

Streamlining HR and Administrative Processes

An Employer of Record will have a team of experienced HR professionals responsible for streamlining and developing your HR and administrative processes. This enables you to focus on developing the core competencies of your business.

Enabling Flexibility and Scalability in Workforce Management

Your Employer of Record can help you retain top talent and keep employees engaged, ensuring that you maintain high performance to enable growth and scalability for your business.

How to Engage an Employer of Record in the Philippines

There are three steps you can take before you start engaging an Employer of Record in the Philippines.

Evaluating Your Business Needs and Objectives

What are the short and long-term goals you want to achieve for your business? Knowing your objectives will help you identify the staffing requirements you need to address as well as the employment processes you need to build.

Selecting a Reputable Employer of Record Provider

Do your due diligence when it comes to searching for a dependable EOR provider. Check references from existing clients and make sure that a potential provider has similar values and principles to your business.

Contracting and Onboarding Process

An EOR provider must provide a clear and seamless contracting and onboarding process if you decide to partner with them. This ensures that you are aware of the employment processes they have in place for your team.

Case Study: Daivergent builds a global remote working culture with Remotify

Daivergent is an all-digital job-creating platform for the disability community, helping neurodivergent individuals transition into adulthood by equipping them with the necessary skills for employment, social interactions and independent living.

As its Employer of Record, Remotify strengthens Daivergent’s remote global culture by ensuring that its workforce is fully engaged and supported in the staff’s HR needs.

"Remotify supports us by making sure we don’t have to do anything HR-related. Everything from salary verification or handling an off-boarding of an employee and understanding the legal and administrative risks. Being able to trust Remotify allows me to focus on growing my business." — Byran Dai, CEO and co-founder of Daivergent

Frequently Asked Questions

1. What is the role of an EOR?

An Employer of Record (EOR) acts as the employer for an organization’s employees. An EOR handles the administrative HR tasks within an organization so that business owners can focus on more important tasks.

2. How does an Employer of Record differ from traditional employment?

International organizations are required to set up an entity within a country if they want to legally hire local employees. This is a costly and time-intensive process. Utilizing an Employer of Record allows businesses to skip all the hassle while ensuring that they stay compliant with local labor laws as they build their team in the region.

3. What industries can benefit from EOR services in the Philippines?

An Employer of Record can be useful in almost any industry, but five types of businesses will maximize the benefits of EOR services:

- Startup companies

- Small to medium enterprises

- Companies in fast-paced industries (e.g. tech and digital marketing)

- Companies with project-based needs

- Companies seeking to test new markets

4. How can an EOR help with workforce scalability?

An Employer of Record can help you downsize or expand your team, depending on your business requirements. A partnering EOR will also ensure that you have the necessary HR-related processes in place for seamless transitions for both new and exiting employees.

5. What are the cost implications of engaging an EOR in the Philippines?

International businesses can save up to 70% when they outsource in the Philippines. Utilizing an Employer of Record also ensures a quick deployment of local employees in the organization.

Jump straight to a key chapter

Spending Too

Much Time

Onboarding?

your remote hiring in the

Philippines, excellently.

Say Goodbye to High Costs!

Request Your Free Consultation Today andSave a Massive 70% on Your Workforce!

Ready to thrive in a remote-first work environment?