If you've been considering outsourcing your accounting, you couldn't have picked a better place than the Philippines. You see, the Philippines is like a treasure chest for businesses, brimming with options. Whether you're a startup in the throes of the hustle or a well-established company, there’s an outsourcing solution that's got your name on it. The beauty of it all? You get top-notch services without burning a hole in your pocket! And remember, the key to a successful outsourcing partnership is finding a provider that aligns with your business values and needs. So, don’t be afraid to do a little digging, ask questions, and negotiate terms. It's your business after all, and it deserves the best!

Key Takeaways

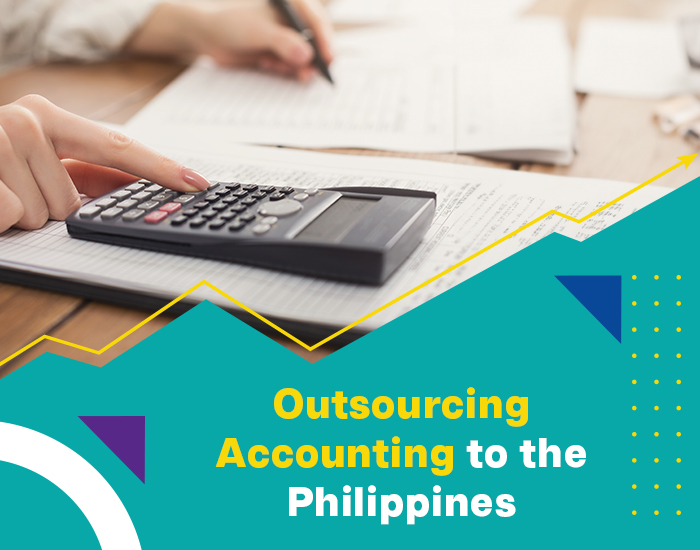

Outsourcing accounting to the Philippines might seem like a big step, but let's break it down:

- World-class talent at your fingertips: The Philippines is bursting with highly qualified professionals who are just waiting for the opportunity to excel. Don't worry - language is no barrier! With English as one of their official languages, communication is smooth sailing.

- Cost-effective services: You'll be amazed at the excellent service you get for a fraction of the cost! And it doesn't end at bookkeeping - you can outsource everything from financial planning to fraud prevention.

- Take advantage of the tech: Embrace the future, where artificial intelligence (AI) and robotic process automation (RPA) make remote accounting a breeze. And with most tasks being automated, you're guaranteed more accuracy and efficiency.

- Security is a priority: Rest assured, your financial data is safe. A secure data storage system and non-disclosure agreements are part of the package when you outsource accounting services to the Philippines.

- Communication is key: You'll find it easy to stay in touch with your remote team, thanks to digital tools like video conferencing and collaboration software.

- Remotify EOR can help: At Remotify EOR, we'll help you find the best providers in the Philippines while taking care of all legal, tax, and payroll compliance matters. Let us help make sure that your business gets the most out of outsourcing accounting services.

Hire from the various types of remote accountants with Remotify

- Certified Public Accountant (CPA)

- Junior Accountant

- Forensic Accountant

- Auditor

- Management Accountant

- Cost accountant

- Accounting Manager

- Government Accountant

- Project Accountant

- Investment Accountant

- Staff Accountant

- Accounting supervisor

- Tax Accountant

- Assistant Accountant

- Accounting Manager

Advantages of Outsourcing Accounting to the Philippines

- Cost-Effectiveness: Outsourcing accounting and finance services from the Philippines is cost-effective. Accounting firms in the country offer more competitive prices for comparable quality of work when compared to other countries.

- Time Zone Advantage: The Philippines' time zone is just an hour behind China's, which makes it easier for businesses to quickly discuss and review financial reports while their teams are online at the same time. This helps businesses make quick decisions and move their operations forward.

- Access to Skilled Resources: The Philippines has a large pool of highly qualified accountants who are trained in the latest accounting software packages, allowing for accurate financial reporting and analysis.

- Reliability: Filipino accountants understand the value of hard work and follow processes diligently. They are also very reliable when it comes to meeting deadlines and providing accurate work.

- Language Advantage: English is the official language in the Philippines, so communication with Filipino accountants is relatively easy. This eliminates any potential language barriers between you and your accounting team.

- Modern Technological Infrastructure: The Philippines has a well-developed internet infrastructure, which allows for reliable data transmission and secure communication. This makes it easier for businesses to stay connected with their remote accounting teams in real-time.

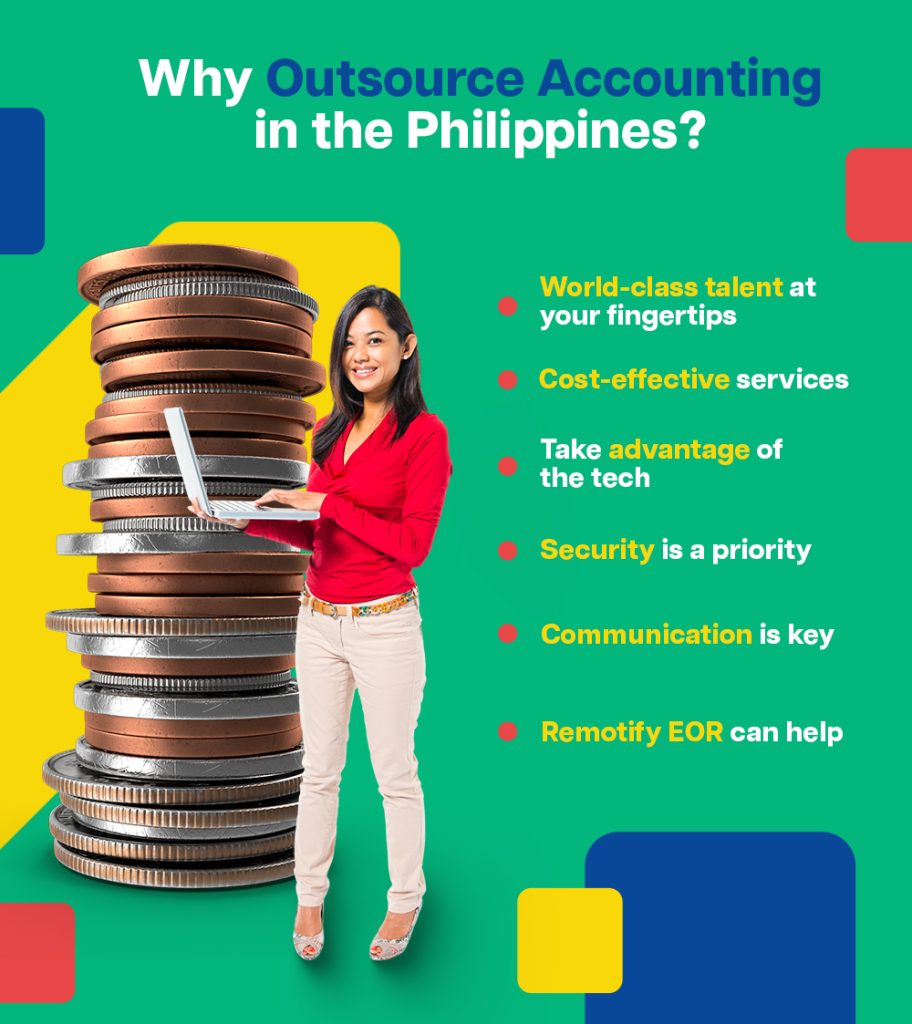

Setting Up Your Outsourcing Team

Defining Your Accounting Needs

Before you start looking for a remote accounting team, it's important to have a clear understanding of your key requirements. This will help you decide on the type of accountants you need and how many of them you should hire. Think about what tasks or projects you need help with and how much time each task is likely to take. Knowing this information will make it easier to decide on the size of your management accounting team.

Choosing the Right Outsourcing Partner

Once you’ve identified your accounting outsourcing needs, the next step is to find a reliable outsourcing partner. With so many options out there, it can be difficult to make up your mind. We recommend that you do some research and ask around. Read reviews on different providers and compare their services with one another. Alternatively, you could use an online platform like Remotify to easily filter and connect with the right professionals for your project.

Recruitment and Training Process

Once you’ve identified a potential service provider here, the recruitment and training process can begin. Make sure to interview each candidate thoroughly and make sure that they have the skillset and experience needed for your project. Additionally, consider providing them with some on-the-job training as it will ensure that they understand your specific requirements better. This will help foster an effective working relationship between you and your team.

Remote Working Tools

One of the most important aspects of successfully managing a remote finance and accounting team is having the right tools in place. Investing in good remote working tools such as project management software, video conferencing apps, or collaboration platforms can ensure smooth communication with your team and help streamline data transfer processes.

Overcoming Cultural and Communication Barriers

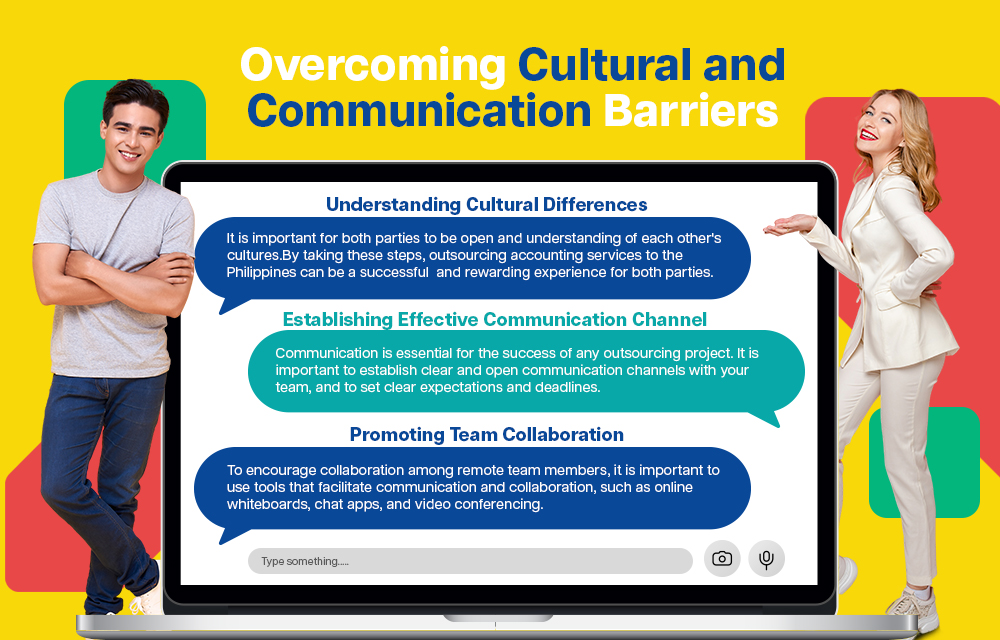

- Understanding Cultural Differences: While outsourcing accounting services to the Philippines may have a lot of advantages, it also comes with certain challenges. One such challenge is cultural differences—making sure both sides understand each other’s values, expectations, and working styles.

- Establishing Effective Communication Channels: Communication is key to the success of any outsourcing project. Make sure you establish an effective communication channel with your team and set guidelines for how often you should check in, what tasks need to be done by when, etc. This will help ensure that everyone is on the same page and prevent potential misunderstandings.

- Promoting Team Collaboration: Although working remotely can be challenging, it can also lead to more collaboration among team members. Encourage your team to share ideas and feedback regularly, and use tools such as online whiteboards or chat apps to facilitate brainstorming sessions.

Legal and Security Considerations

Data Security and Privacy Measures

When outsourcing accounting services, it's important to take the necessary data security and privacy measures. This will ensure that all confidential customer information is kept secure at all times. Ensure that your provider has a secure data storage system in place and requires its employees to sign non-disclosure agreements (NDAs). Additionally, make sure that they comply with any relevant accounting industry regulations such as GDPR.

Legal Requirements and Tax Regulations

It's also important to understand the legal requirements and tax regulations for outsourcing the finance and accounting industry and services in the Philippines. This will help ensure that you're following all applicable laws and regulations and reduce potential risks associated with hiring remote workers. Check with local authorities to make sure your provider is compliant and licensed, and verify that they are paying all necessary taxes.

Compliance with International Laws and Regulations

Finally, it's important to consider international laws accounting standards and regulations. Depending on where your business is based, you may need to comply with specific rules for outsourcing services abroad. Research the regulations in your home country before signing any contracts or agreements with an offshore provider.

Navigating Intellectual Property Concerns

When outsourcing accounting services, intellectual property concerns may arise. Make sure that you and your provider are clear about who owns the rights to the data or information produced by their team accounting staff. Additionally, consider signing an agreement that specifies each party's intellectual property rights and ensures that all confidential information is held securely.

Managing Outsourced Accounting Operations

- Supervising Remote Teams: When outsourcing accounting services, it's important to keep an eye on your remote team and make sure everyone is working efficiently. Set clear objectives for each project, establish deadlines, and create detailed reports that track performance and progress.

- Setting Expectations: Establishing expectations with your team will help ensure that they understand what is expected of them and can deliver results.

- Implementing Performance Metrics: To better understand your team's performance, consider implementing performance metrics such as customer satisfaction surveys or feedback forms. This will help you gain valuable insights into how your team is doing and identify areas of improvement.

- Resolving Disputes: When outsourcing accounting services, it's important to be prepared for any potential disputes that may arise. Make sure you're familiar with the laws and regulations in the Philippines, and consider having a dispute resolution process in your contract. This will ensure that any conflicts or misunderstandings can be quickly addressed and resolved.

- Addressing Challenges and Solutions: As with any outsourcing project, there may be challenges that arise during the course of your engagement. It's important to stay on top of these issues and address them promptly so they don't hinder the progress of your project. Utilize your team's expertise and experience to come up with creative solutions to any problems or roadblocks you encounter.

Future Trends in Outsourced Accounting

- Advancements in Technology: As technology continues to evolve, it will become easier and more efficient to outsource accounting services. Cloud-based software tools such as artificial intelligence (AI) and robotic process automation (RPA) are becoming increasingly popular for streamlining remote accounting processes.

- Automation of Accounting Tasks: Automation is transforming the way businesses manage their financial operations. By automating certain accounting tasks, businesses can reduce costs and increase efficiency. Automation also makes it easier to collect data, track progress, and analyze financial information.

- Expanding Beyond Traditional Accounting Services: Accounting services are no longer limited to traditional tasks such as bookkeeping and payroll management. Companies are now outsourcing a variety of services including data analytics, financial planning, and fraud prevention.

- Evolving Roles of Accounting Professionals: As technology advances, the roles of accounting professionals are shifting. Accountants are now tasked with analyzing data and providing insight into financial trends, rather than simply crunching numbers. This shift will require accountants to have a more strategic mindset and gain new skills such as coding and analytics.

Easily Outsource Accounting to the Philippines with Remotify Employer of Record

Finding reliable and cost-effective providers in the Philippines can be a daunting task. Remotify Employer of Record makes it easy to quickly find and hire top accounting and financial professionals from the Philippines. Our platform allows you to manage your hiring process remotely, while our team of experts handles all legal, tax, and payroll compliance matters for you.

With Remotify Employer of Record, you can easily and securely outsource accounting services to the Philippines. Hire professionals from the country with confidence—we've got you covered! Get started today and take advantage of our range of services to make outsourcing accounting easier. With our help, you can focus on growing your business while we take care of all the paperwork.

Frequently Asked Questions

Is outsourcing accounting to the Philippines legal?

Yes, outsourcing accounting to offshore accountants in the Philippines is legal. Make sure you research and understand the applicable laws and regulations in your home country as well as those in the Philippines before signing any contracts or agreements with an offshore provider. Additionally, ensure that your provider is compliant and licensed, and verify that they are paying all necessary taxes.

How can I ensure the security of my financial data?

When outsourcing accounting services, it's important to ensure the security of your financial statements and data. Make sure that your provider has a secure data storage system in place and requires its employees to sign non-disclosure agreements (NDAs). Additionally, verify that they comply with all relevant industry regulations such as GDPR.

What accounting tasks can be outsourced?

Most accounting tasks can be outsourced, including bookkeeping, payroll management, tax preparation, financial planning, auditing, and data analytics. Depending on your needs and budget, you may choose to outsource all or just some of these services.

How can I effectively communicate with my outsourced team?

Effective communication is essential when outsourcing accounting services. Utilize clear guidelines and set expectations for both parties to ensure that everyone involved understands the project requirements and timeline. Additionally, consider utilizing digital tools such as video conferencing or collaboration software to make it easier to communicate with your remote team.

So, are you ready to take the plunge and outsource accounting and finance needs to the Philippines? Remember, with Remotify Employer of Record, we've got your back every step of the way. Let's get start

Jump straight to a key chapter

Spending Too

Much Time

Onboarding?

your remote hiring in the

Philippines, excellently.

Say Goodbye to High Costs!

Request Your Free Consultation Today andSave a Massive 70% on Your Workforce!

Ready to thrive in a remote-first work environment?